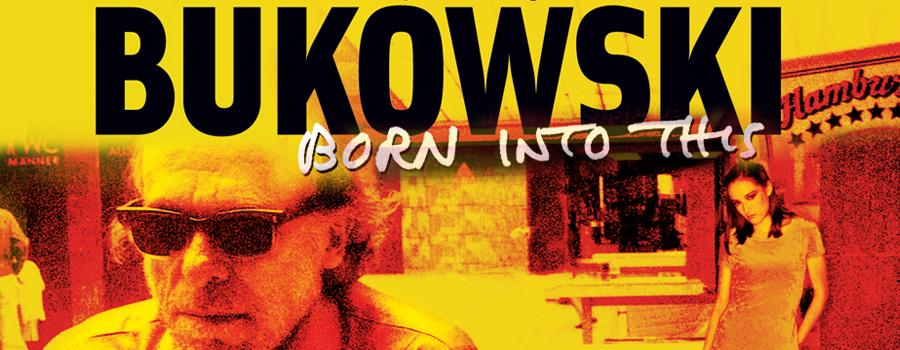

Bukowski: Born into This produced by John Dullaghan is a great glimpse at the life and work of Henry Charles Bukowski. Watch it here on Vimeo or here on YouTube.

Author: anautonomousagent (Page 48 of 75)

Zooniverse allows anyone to participate in scientific studies. For example, there is a project called Seafloor Explorer which allows users to scan pictures of the seafloor looking for animal species and types of ground cover to create a vast library of information. There is a project which asks for help in identifying various explosions on the sun and another which finds exoplanets around stars.

Let’s say that you have started an IRA or some sort of long term retirement account. One strategy would be to invest 100% of your money in an index fund which follows the S&P 500. This would give you around 9 – 11% annual average returns over 50+ years. However, you will notice that there are several times throughout the life of the account in which the index suffers massive losses.

To counteract these loses it would be wise to find another index, such as a short term bond fund, where you could temporarily store your returns; then, once the market has crashed, you could invest these funds back into the stock market.

This strategy is a modified version of the one suggested by Benjamin Graham in The Intelligent Investor. His strategy was to always be in a range of 25-75% in a bond and stock fund. In other words, never have your portfolio more than 75% or less than 25% in either bonds or stocks. Then, depending on whether you “felt” the market was too optimistic or too pessimistic you would adjust your ratios accordingly. I feel that this idea of optimism and pessimism can somehow be quantified and developed into an algorithm.

Take two index funds: the S&P 500 index fund and a two year bond fund. Both have minimal expenses (Vanguard funds). The strategy is simple. Begin with 70% in stocks and 30% in bonds and wait 24 months. Now, check the past 24 months. Is there a gain or loss of magnitude greater than 50% in the S&P 500 index during this period? If true, then readjust your portfolio. If it is a gain, then bring the portfolio back to 70% S&P 500 index and 30% bond fund. If it is a loss, then bring the portfolio to 95% S&P 500 and 5% bond fund. Repeat this process every 24 months. Also, make sure you continue to make monthly deposits 50-50 into the stock and bond funds.

Performing this strategy with certain adjustments in these ratios will allow the investor to achieve better than market annual average returns for 50+ years. I am currently trying to work out the exact results and best parameters of this strategy. I believe these returns will be even better depending on the amount invested per month.

Sadly, most people make the mistake of decreasing their stock holdings right after a crash and increasing their stock holdings during a bull market which precedes a crash. This psychological reflex will lower the net return drastically.

Almost sixteen years have elapsed since the Ministry of Sound’s release of Northern Exposure. Mixed by DJ Sasha and John Digweed, Northern Exposure and its sequels are all masterpieces which will never die. Here are the YouTube links for these mixes:

Northern Exposure – Disc1/North (Buy here)

Northern Exposure – Disc2/South

Northern Exposure 2 – West Coast (Buy here)

Northern Exposure 2 – East Coast (Buy here)

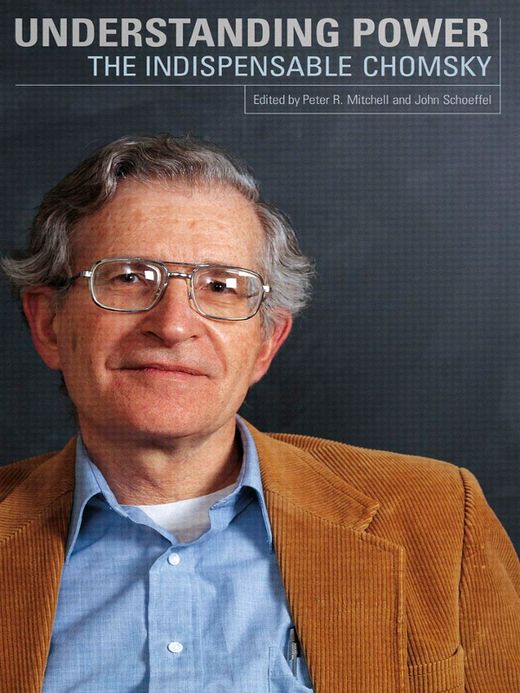

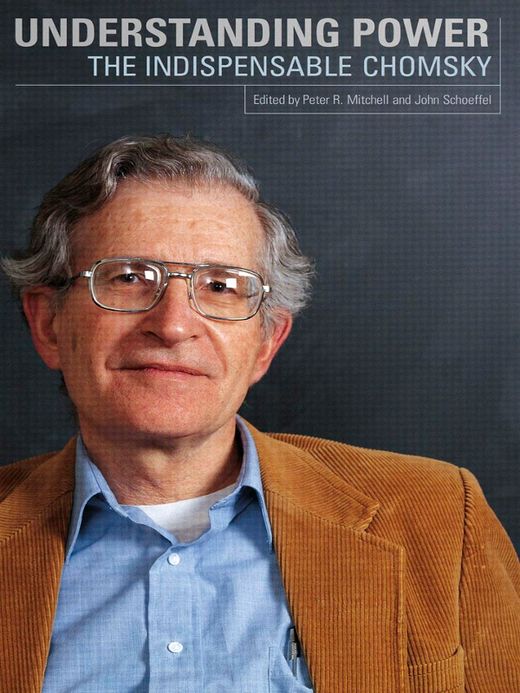

In Understanding Power: The Indispensable Chomsky, Noam Chomsky explains political motives and modern history in a straightforward manner, showing the truth behind the decisions of governments. These are the facts and details never heard on public news stations and newspapers. I would definitely suggest reading this collection of talks by Chomsky.