In No One Would Listen: A True Financial Thriller, Harry Markopolos, the financial fraud detective who studied Bernie Madoff’s questionable returns in early 2000, narrates the entire history and investigation of Bernie Madoff’s ponzi scheme — starting in 1998. I was shocked, as was Markopolos, on learning about the negligence and failure of the SEC on numerous occasions. The book provides a good summary account of the Madoff fraud and the people involved. It also provides important insight into financial fraud, reform, and regulations.

Category: business

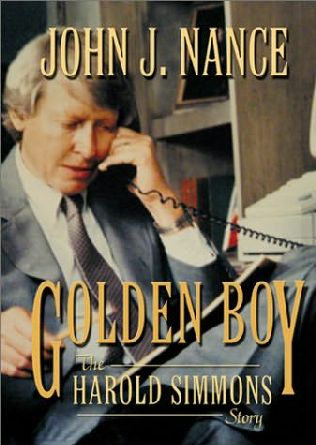

I was a long term investor in Harold Simmons’ Keystone Consolidated Industries and now I am currently sitting on a nice return from an investment in Valhi. Being a coattail investor in his companies has paid off — if you can enter at a low price. Some have called him an “Evil Genius” and even a crook. However, I find his story to be an amazing story of business success, legal battles, and cunning financial maneuvers to become an icon of the rags-to-riches success story. His biography, written by John J. Nance and entitled Golden Boy: The Harold Simmons Story, provides a great account of the building of his empire.

To gain a better understanding of the investment philosophy and managerial skill of Warren Buffett I would suggest reading his book: The Essays of Warren Buffett : Lessons for Corporate America.

After reading many books and articles by Benjamin Graham, I decided to read about the infamous Warren Buffett. The Snowball: Warren Buffett and the Business of Life provides a lengthy and detailed account of the life of Warren Buffett. Although it offers no direct advice on investments, the reader will gain insight into the mind and lifestyle of one America’s greatest financial minds.

After reading the biography, I believe that his success lies in no specific investment strategy. It is his overall outlook on life and common sense approach to investing which allows him to avoid the extremes of risk. (ISBN-13: 978-0553384611)