Common Stocks and Uncommon Profits explains the investment philosophy of Philip A. Fisher. This book, also recommended by Warren Buffett, supplies the investor with a set of “rules” called the Fifteen Points. Fisher advises one to buy and hold a growth stock “forever” while following the Fifteen Points.

Category: finance (Page 6 of 6)

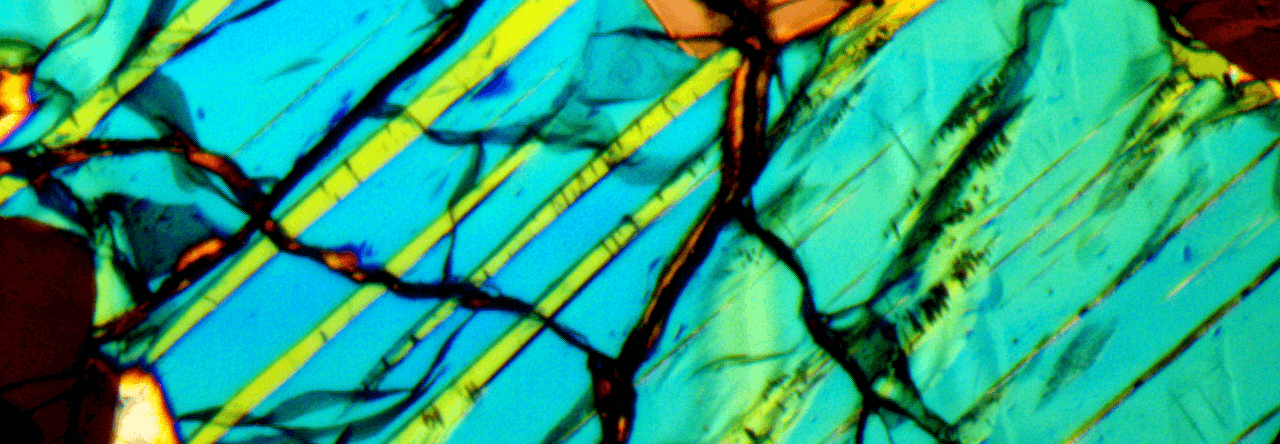

Why Stock Markets Crash by Didier Sornette could be one of the most creative and unique scientific approaches to understanding the stock market I have read. The approach lies in complexity theory and involves identifying properties of critical self-organizing systems. I highly recommend this book for any reader interested in complexity theory, self-organization, and financial markets.

After reading the Intelligent Investor, I decided to read Security Analysis, both by Benjamin Graham and David Dodd. Warren Buffett mentions repeatedly that this is one of the best books on investments. I have read the book twice and I agree with Buffett.

The Intelligent Investor by Benjamin Graham gives the reader a great introduction to the investment philosophy of Benjamin Graham and David Dodd.

After reading many books and articles by Benjamin Graham, I decided to read about the infamous Warren Buffett. The Snowball: Warren Buffett and the Business of Life provides a lengthy and detailed account of the life of Warren Buffett. Although it offers no direct advice on investments, the reader will gain insight into the mind and lifestyle of one America’s greatest financial minds.

After reading the biography, I believe that his success lies in no specific investment strategy. It is his overall outlook on life and common sense approach to investing which allows him to avoid the extremes of risk. (ISBN-13: 978-0553384611)