To me, the idea of infinite memory processes is one of the most important concepts touched on by Mandelbrot in this book. It suggests that economists and traders should be developing models and theories which value the importance of price series and data going back decades. And it makes sense to me that people and prices do not change their fundamental behavior over extended periods of technological evolution. However, I suspect that organisms do change their fundamental behavior if the time horizon is thousands or millions of years. I am very curious to read more about Hurst’s studies of the Nile.

Category: fractals (Page 1 of 2)

Books:

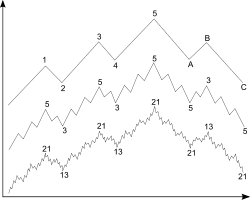

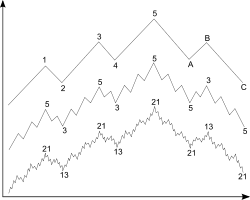

Elliott Wave Principle: Key to Market Behavior

The Wave Principle of Human Social Behavior and the New Science of Socionomics

Articles:

An Introduction to the Elliott Wave Principle – Jordan Kotick

Multi-classifier based on Elliott wave’s recognition

Fuzzy time-series based on Fibonacci sequence for stock price forecasting

Elliott Wave Theory and neuro-fuzzy systems, in stock market prediction: The WASP system

Unconscious Herding Behavior as the Psychological Basis of Financial Market Trends and Patterns

Videos:

Steven Pinker talking about how language helps scientists understand cognition.

Steven Pinker: Linguistics as a Window to Understand the Brain

Nicholas Christakis talks about important revolutions in understanding the social sciences.

Nicholas Christakis: The Sociological Science Behind Social Networks and Social Influence

Benoit Mandelbrot interview, talking about fractals.

Big Think Interview with Benoit Mandelbrot

Richard Dawkins interview, talking about evolution and other related topics.

Richard Dawkins – Evolutionary Biologist – Big Think – discussing a multitude of scientific topics

First time I have heard about Stewart Brand; really smart and wise guy.

Big Think Interview With Stewart Brand

Why Stock Markets Crash by Didier Sornette could be one of the most creative and unique scientific approaches to understanding the stock market I have read. The approach lies in complexity theory and involves identifying properties of critical self-organizing systems. I highly recommend this book for any reader interested in complexity theory, self-organization, and financial markets.

Hofstadter’s Butterfly, what a beautiful self-repeating pattern! Discovered by Douglas Hofstadter.

|

| Credit |