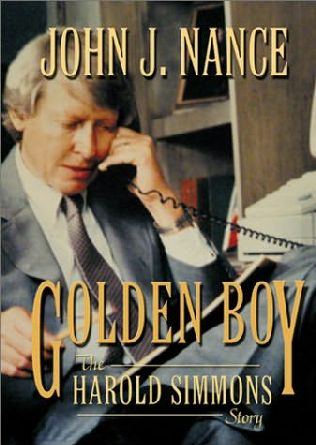

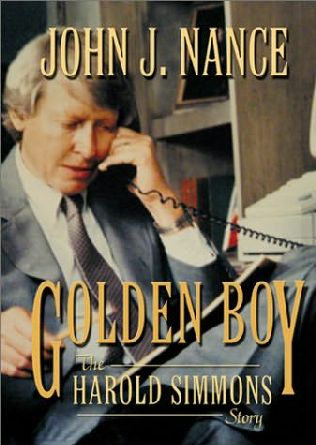

I was a long term investor in Harold Simmons’ Keystone Consolidated Industries and now I am currently sitting on a nice return from an investment in Valhi. Being a coattail investor in his companies has paid off — if you can enter at a low price. Some have called him an “Evil Genius” and even a crook. However, I find his story to be an amazing story of business success, legal battles, and cunning financial maneuvers to become an icon of the rags-to-riches success story. His biography, written by John J. Nance and entitled Golden Boy: The Harold Simmons Story, provides a great account of the building of his empire.

Category: harold simmons

My first foray into the stock market was after reading the books of the popular writer, Jim Cramer. And it resulted in buying several penny stocks which were developing “revolutionary” new products. They did rather poorly and I decided to try buying stocks of more well-known companies, like Goldman Sachs and some others which I do not remember. This was in 2007-8 and the tiny gains from my small investments were financially negligible; however, it was an experience.

My knowledge of markets began to change as 2008 progressed into 2009 and I gained experience trading stocks. I lost interest in Cramer and found the work of Benjamin Graham to be far more fascinating. While in high-school I was fascinated by Benjamin Graham’s record of success and his value investing approach to choosing investments. My interest continued as an undergrad in college; I remember reading all of Graham’s articles while sitting through accounting class. Reading Security Analysis more than twice, I attempted to put my newly learned skills to the test. The potential to find muddied gems hidden from view by the dirty coating applied by “Mr. Market” spurred my desire to master the art.

There were a few stocks which I had bought at various times during the period of 2008-9; they fell and rose with the rest of the market during the roller coaster ride from which many people still feel dizzy. One was Reddy Ice, which ended up bankrupt. However, I did not have much money to invest until after the downturn. In this favorable condition I began to search through hundreds, if not thousands of stocks. The final list of suitable candidates fitting Graham’s criteria included a steel producer called Keystone Consolidated Industries. Owned mostly by Harold Simmons’ Contran, the stock had a market value of $36 million. Having a pension fund the size of Texas and a decent sized steel operation (around $500 million of sales per year), I felt this was the best choice. It turned out to be a wise investment, as I finally liquidated my position when Contran finally purchased all the shares at around $9.00. Even at this price, the company’s market value was only around $100 million — a real bargain for Contran, since the pension fund had around $700 million in assets at the time and only $350 in NPV of pension obligations; not to mention the profitable steel company. Carl Icahn, the only other large shareholder, said not a word at the paltry price of $9. To this day, I still believe a fair price should have been at least $20 per share. Despite most of the value being reaped by Contran and Simmons on this transaction, I did benefit.

After this success (and the passing of three years), I found that I lacked the same fascination with Graham as I did a few years before. I think my interest waned as I witnessed “Mr. Market” in action and I realized first hand that market sentiment played a huge role in price determination. “How could people not see the value?” I always asked myself. “Was this a flaw in Graham’s strategy?” And it was precisely this question which led me to realize that people and markets are far from efficient. Graham’s method is only successful for a large diversified portfolio of undervalued stocks. In fact, I really think that value does not exist as an absolute quantifiable truth; value only exists as a social relationship between commodities as Marx writes in Das Kapital. And by doing so, its expression is subject to the whims of human emotion. It is with this perspective which I began reading about the behavior of traders and markets.

Today I am surprised to learn that Harold Simmons passed away in December of 2013. He was a clever man who grew a few thousand dollars into billions.