After watching an interview with Michael Talbot on YouTube, I was eager to read his book, The Holographic Universe. Despite being published in 1991, the book contains a wide range of references and resources perfect for any reader in 2016 interested in the boundary between science and the paranormal. I recommend this book, not because it provides profound new insight, but because of the huge number of paranormal examples (if legitimate) and historical occurrences with which any reader may have a difficult time fitting into their framework of reality. Of course, it is unwise to accept anything you read as truth; however, the source material is listed and the reader can stroll down any path he/she wishes in their own personal investigation of these topics. My own path is now taking me into the work of Dr. Stanislav Grof, Rick Strassman, etc… and topics such as LSD, DMT, NDEs and OBEs.

Category: psychology (Page 2 of 2)

I only recently started listening and reading the ideas of Terence McKenna. His communication skill and talks do a great deal to guide the mind to new planes of thought and his experiences are fascinating to say the least. Do a search on YouTube; a few I enjoyed:

Eros and the Eschaton “What Science Forgot”

Opening the Doors of Creativity

Terence McKenna’s True Hallucinations

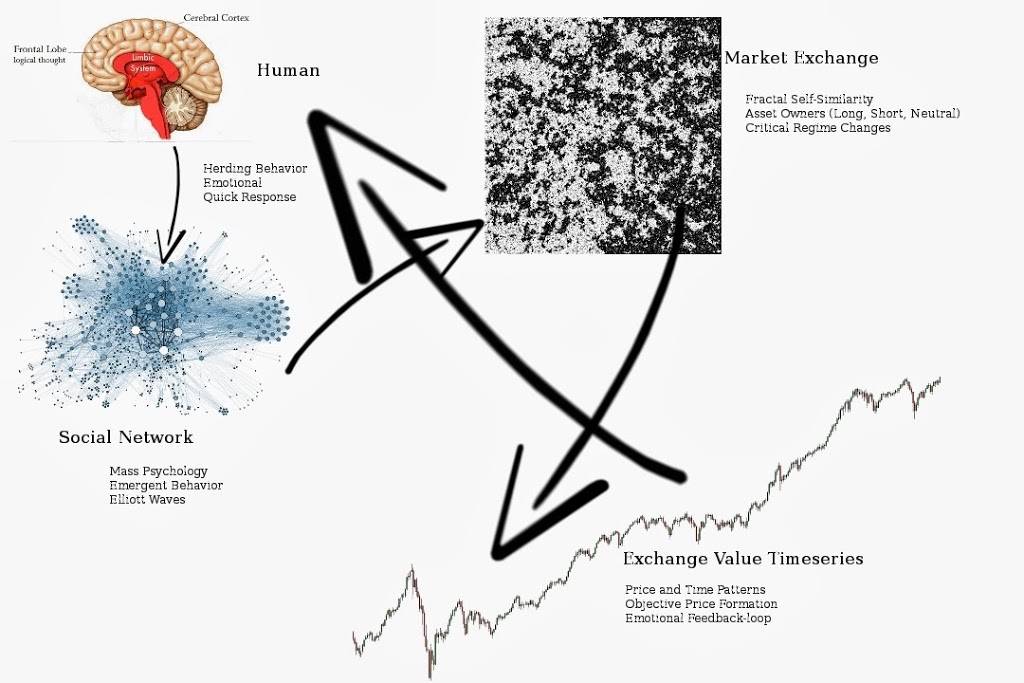

I think that live price data is important, however, there are far more important numbers to be recorded in a financial market. Live data such as: current number of shares long; current number short; size of investor gain (or another measure to see how long a specific investor has been holding his/her position), etc.

Price can change in a matter of micro-seconds; in the 1930’s this observational task would have been deemed impossible — keeping track of such rapid price changes. Now, computers allow humans to do this with ease. What is preventing society from recording and publicly displaying other data in rapid manner. In other words, can we not use our computers to observe the ubiquitous “invisible hand” of market exchange?

I can only imagine visualizing this data analogously with the video showing flights traveling around the world:

Now, imagine that all the flights leaving Europe are people exiting (shorting or selling) an asset. And imagine that all the flights entering Europe are people buying the asset. Obviously, some issues since # of buyers == # of sellers in real market.

I posted before about the Elliott Wave Principle and several books dealing with the subject. However, I feel the need to reiterate the importance of two books by Robert R. Prechter, Jr. They are: The Wave Principle of Human Social Behavior and Pioneering Studies in Socionomics. I purchased both these books in a two volume collection called, Socionomics: The Science of History and Social Prediction. In all my studies as an undergraduate and graduate student in the field of finance and mathematics, not one professor has ever mentioned Prechter or Elliott.