Why Stock Markets Crash by Didier Sornette could be one of the most creative and unique scientific approaches to understanding the stock market I have read. The approach lies in complexity theory and involves identifying properties of critical self-organizing systems. I highly recommend this book for any reader interested in complexity theory, self-organization, and financial markets.

Category: stocks (Page 6 of 6)

After reading the Intelligent Investor, I decided to read Security Analysis, both by Benjamin Graham and David Dodd. Warren Buffett mentions repeatedly that this is one of the best books on investments. I have read the book twice and I agree with Buffett.

The Intelligent Investor by Benjamin Graham gives the reader a great introduction to the investment philosophy of Benjamin Graham and David Dodd.

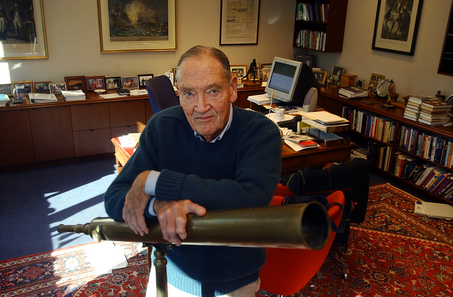

John Bogle on Investing: The First 50 Years provides a good insight into the mind of John Bogle, the founder of The Vanguard Group. The only book I have read by Bogle, it explains in detail his belief that individual stock picking is not worth the effort. Instead, Bogle argues that the variance of the return on a total market index decreases as an investor considers a longer time horizon. In other words, the fifteen year return will tend to converge toward the fifteen year average return. A more detailed explanation is provided in the book. This approach suggests that the best strategy would be to invest in a low expense fund that follows either the S&P 500, the Wilshire 5000, or some market index. (ISBN-13: 978-0071761031)