The information contained in Elizabeth Kolbert’s book, The Sixth Extinction: An Unnatural History, should concern all humans alive today. The facts presented have been known to the scientific community for a number of years. Its message is clear and important: the human species has been the chief cause of a massive extinction not seen since the dinosaurs perished. Biological diversity has been decreasing for a long time. She presents the facts in a clear and fascinating story; visiting numerous places around the globe and witnessing first hand the effects of “The New Pangea.” The Washington Post’s review of Kolbert’s book.

Page 29 of 75

Hulu has about 100 of these episodes. The Limits of Perception trilogy and Nature Technology trilogy are some great choices. The is also a great episode on Lapis Lazuli, Egyptians, and Afghanistan. Amazon Prime pleasantly surprised me with some offerings from ORF Universum:

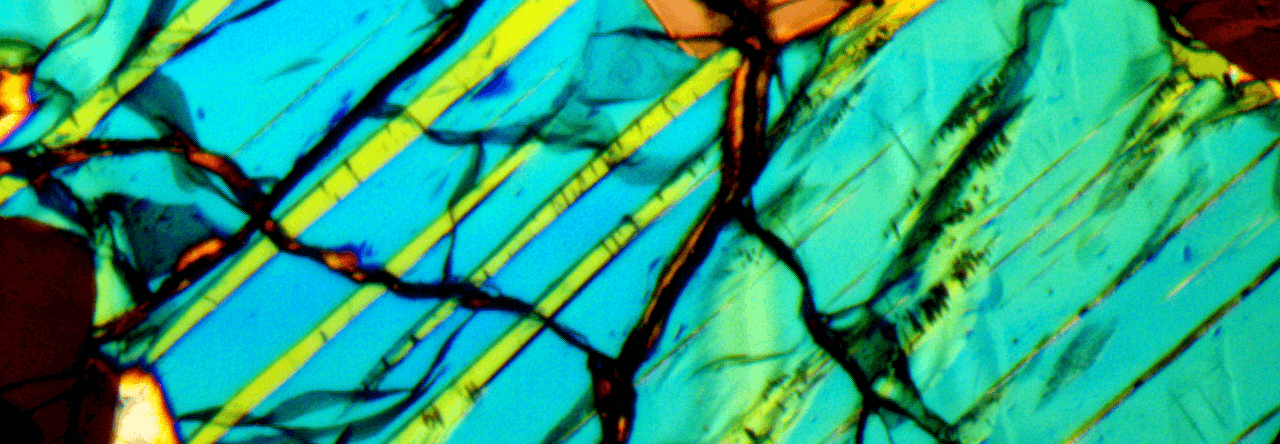

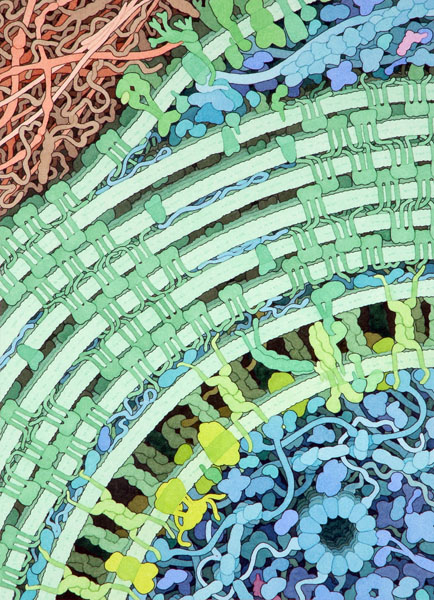

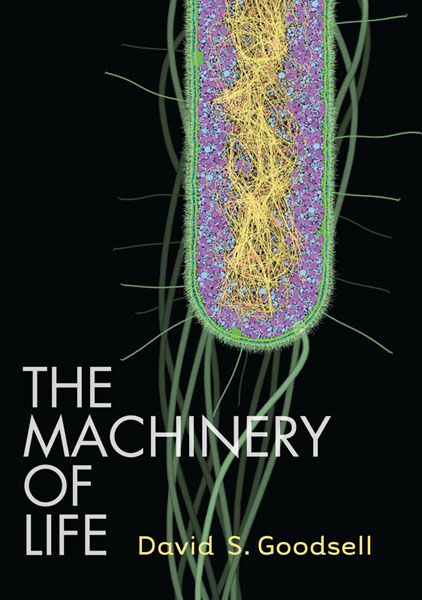

The equisite details of cellular life are quite remarkable. Understanding how life continuously exists and reproduces in all parts of the world and the universe is beyond anything I could ever imagine. Nonetheless, I thoroughly enjoy spending time admiring the microscopic biology all around us; which is why I love David S. Goodsell’s book, The Machinery of Life. You can view many of the pictures here.

I was introduced to the works of Alan Watts by a meditation teacher about three years ago. Since then, I have been interested in mysticism, cognition, Buddhism, and scientism. Don’t ask me why, but these subjects just captivate me. I have been reading the works of various authors such as Douglas Hofstadter, Thich Nhat Hanh, Joseph Campbell, Stuart Kauffman, Francisco Varela, and Jiddu Krishnamurti; but what am I trying to learn; WHY?